JROC NON-ORDER PROGRAMME

In the 2023 Roadmap recommendations, JROC identified the five key themes required to develop the next phase of open banking. JROC asked OBL, together with Pay.UK, to drive forward the following activities, building on previous work.

- Levelling up availability and performance (OBL-led)

- Mitigating the risks of financial crime (OBL-led)

- Ensuring effective consumer protection if something goes wrong (OBL-led)

- Improving information flows to TPPs and end-users (OBL-led)

- Promotion of additional services, using non-sweeping variable recurring payments (VRPs) as a pilot (Pay.UK and OBL).

LEVELLING UP

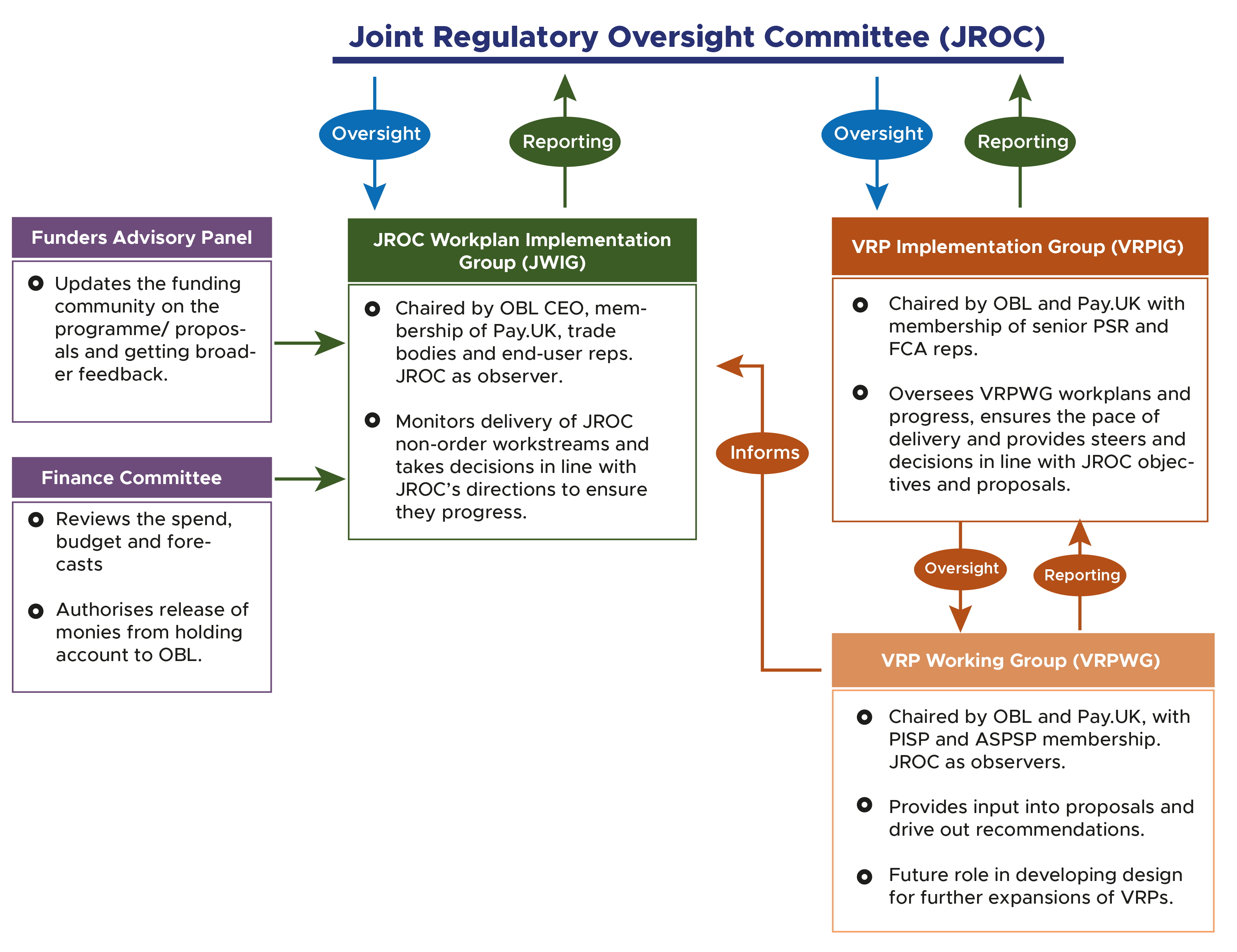

GOVERNANCE

DOCUMENTS

JROC Non-Order Programme Workplan Implementation Group (JWIG)

Terms of reference

Meeting papers:

Document Library

u003cpu003eu003c/pu003eu003cpu003eYou’ll need to demonstrate that you have a PSD2-compliant business model and appropriate data privacy and security measures in place. Get more information on u003ca href=u0022https://www.fca.org.uk/firms/applications-under-psd2u0022 target=u0022_blanku0022 rel=u0022noreferrer noopeneru0022u003ethe FCA websiteu003c/au003e. u003c/pu003eu003cpu003eThis checklist will help you make sure your application is as complete as possible. It can can take 3-12 months to secure FCA regulation, depending on the quality of your application. u003c/pu003eu003cpu003eu003cstrongu003eRead FCA guidanceu003c/strongu003e – chapter three of ‘Payment Services and Electronic Money’ explains authorisation and registration. u003c/pu003eu003cpu003eu003cstrongu003eKnow your definitionsu003c/strongu003e – are you offering an Account Information Service (AISP)? A Payment Initiation Service (PISP)? A Card-Based Payment Instruction Issuer service (CBPII)? It’s important to be clear about how your service fits the regulator’s definitions. u003c/pu003eu003cpu003eu003cstrongu003eShow a clear business modelu003c/strongu003e – give straightforward explanations of your business model and typical transactions. u003c/pu003eu003cpu003eu003cstrongu003eCheck policies and proceduresu003c/strongu003e – to get regulated you must have specific policies and procedures in place.u003c/pu003eu003cpu003eu003cstrongu003eDemonstrate complianceu003c/strongu003e – you’ll need to show how your security, data storage, IT and policies comply with the regulations. u003c/pu003eu003cpu003eu003cstrongu003eGet insuredu003c/strongu003e – you must have professional indemnity insurance that complies with the regulations. u003c/pu003e

VRP Working Group (VRP WG)

Terms of reference

Meeting papers:

- Download | 17 Oct 24 – meeting and minutes VRP WG

- Download | 03 Oct 24 – meeting and minutes VRP WG

- Download | 19 Sep 24 – meeting and minutes VRP WG

- Download | 05 Sep 24 – meeting and minutes VRP WG

- Download | 22 Aug 24 – meeting and minutes VRP WG

- Download | 08 Aug 24 – meeting and minutes VRP WG

- Download | ToR – VRP Working Group (VRP WG)

Financial Crime Data

No Documents found

JROC Workstream 2a – Financial Crime Data

Contact us

For any specific questions or comments about the documents on this website, please contact openbankingengagement@openbanking.org.uk

For any general questions or comments about JROC’s work, please contact jroc@fca.org.uk